Payday Loans vs Short Term Loans: What's The Difference?

Financial emergencies like medical bills, car and home repairs, or other unexpected expenses can leave us needing quick cash. To meet this demand, lenders offer various loans tailored to different situations. Payday loans and short-term loans are popular options, but many are unclear about their differences. Understanding these distinctions is essential to choosing the right loan for your needs. As experts in short-term borrowing, we're here to guide you through these options and help you make an informed decision.

What Are Payday Loans?

As suggested in the name, payday loans are simply a form of short term loan that is typically repaid on the borrower's next payday, usually within 2-4 weeks. However, it depends on the loan company, as some offer payday loans with repayment periods of anywhere between 2-8 weeks. Payday loans offer smaller borrowing amounts, ranging up to R5,000, and tend to have a higher interest rate due to the shorter repayment period.

What Are Short Term Loans?

Short-term loans are a slightly longer-term solution than payday loans, with a repayment period ranging from a couple of weeks to a year, and due to the flexibility of spreading the repayment instalments over longer periods, it makes the overall interest rate lower than payday loans. With the longer repayment terms, it means that larger sums of money can be borrowed, typically ranging from R5,000-R15,000, depending on the company that you approach.

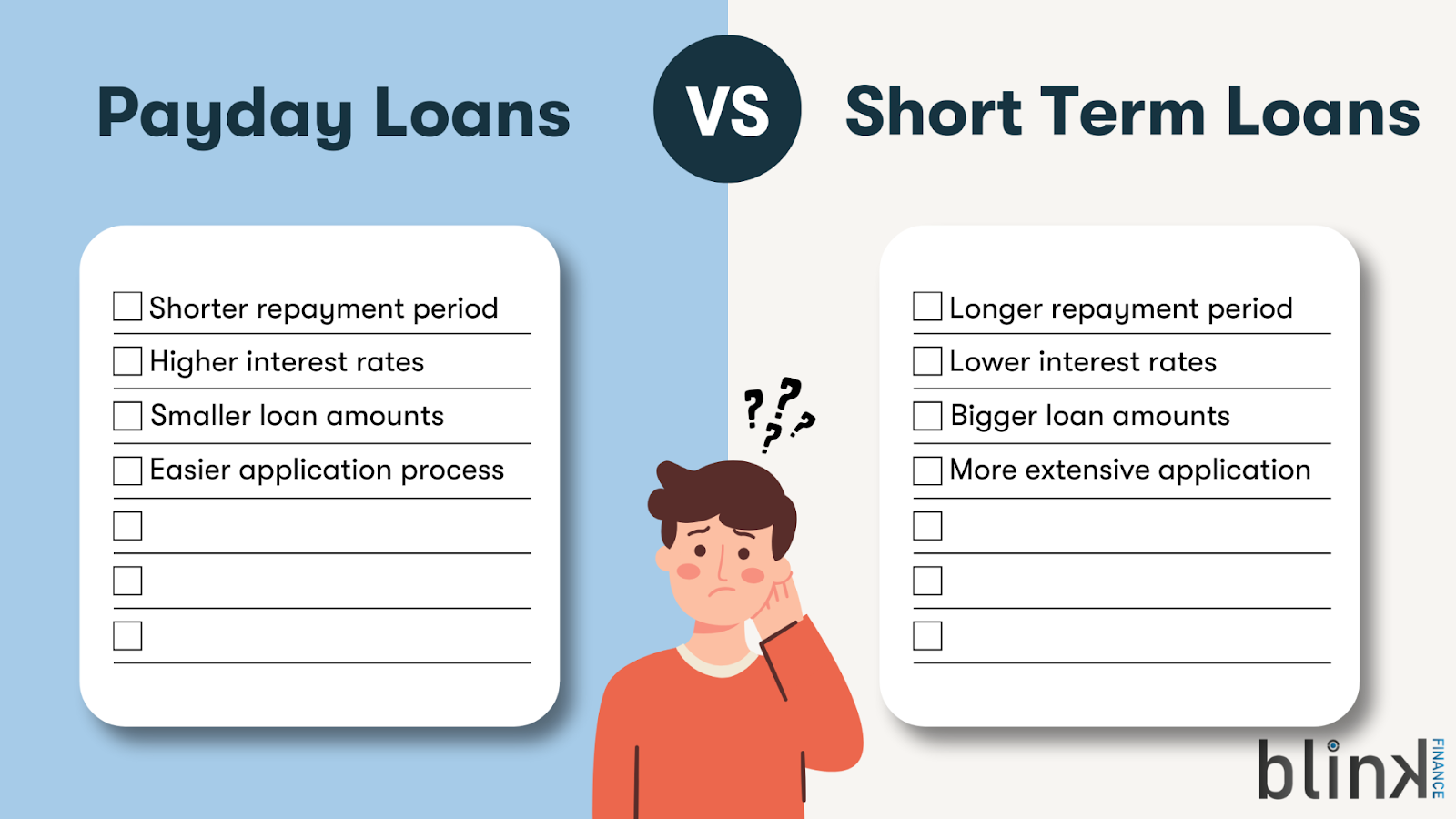

Key Differences Between Payday Loans and Short Term Loans

When you come to understand the key features of each loan type, the differences become abundantly clear, and you'll be able to identify the loan type that suits your financial needs best.

| Repayment Periods | Interest Rates | Loan Amounts | Application Process | |

|---|---|---|---|---|

| Payday Loans | 2-8 Weeks | Up to 5% / month | Up to R5,000 | Simple process - proof of income required. |

| Short Term Loans | 2 Weeks-1 Year | Up to 21% / annum | R2,000 - R20,000 | Longer process - proof of income, employment, and personal details required. |

Repayment Periods

Payday loans tend to require a full lump-sum payment on the borrower's next payday, which is usually within 2-4 weeks of receiving the loan. Whereas short term loans offer a longer repayment window, anywhere from a few weeks to a year, which can ease financial pressure.

Interest Rates

Payday loans typically come with very high interest rates, often reaching monthly interest rates of 5%. In contrast, short-term loans generally offer lower interest rates of up to 21% per annum, making them more affordable and manageable for borrowers over a longer period.

Loan Amounts

When it comes to loan amounts, payday loans typically provide smaller borrowing limits, usually between R500 and R5,000, while short-term loans can offer larger sums, ranging from R2,000 to R20,000 or more, depending on the lender.

Application Process & Eligibility

Due to the smaller borrowing limits of payday loans, they tend to have a quicker and simpler application process, in which they often only require proof of income, making them easier to access in the short term. On the other hand, short-term loans involve a more detailed application process, and you have to meet stricter criteria when it comes to your credit rating and monthly income. Although the process is more extensive, it does mean that larger amounts can be borrowed.

How to Choose the Right Loan for You

Choosing the right loan depends on your financial needs and circumstances. If you need funds urgently for a short-term expense, a payday loan might be a quick solution, but it's essential to ensure you can repay it by your next payday to avoid added fees. For those who need a bit more flexibility, a short-term loan may offer longer repayment terms and more manageable instalments. Always borrow within your means by assessing the exact amount you need and how it fits within your budget. Responsible borrowing is key—understand the terms, consider potential risks, and ensure your repayment plan aligns with your financial situation to avoid unnecessary debt.

The Blink Finance Difference: A Responsible Approach to Short-Term Lending

At Blink Finance, we're committed to providing a responsible and customer-focused approach to payday loans. Our transparent terms ensure you know exactly what to expect from the start, with no hidden fees or surprises. We also offer personalised support to guide you through the borrowing process and help you make informed decisions. With flexible repayment options tailored to suit your circumstances, we aim to make meeting your obligations manageable and stress-free. While short-term loans can have their advantages, Blink Finance's payday loans are designed with your needs and financial well-being in mind.

Payday Loans vs Short Term Loans: Choosing the Right Option

Both payday loans and short-term loans have their unique advantages, depending on your financial needs. Payday loans can provide quick access to funds for immediate expenses, while short-term loans often offer greater flexibility and affordability over a longer period. Regardless of which option you choose, responsible borrowing is essential—ensure you understand the terms, repayment requirements, and how the loan fits into your budget. If you're unsure which option is best for your financial situation, contact Blink Finance today at 012 534 3863 or info@blinkfinance.co.za to speak with a loan advisor and explore your options with confidence.